philadelphia wage tax return

Philadelphia Department of Revenue 1401 John F. You can claim a tax credit pro-rated dollar for dollar for Philadelphia City wage taxes paidwithheld appearing on your W-2 box 19 and 20.

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

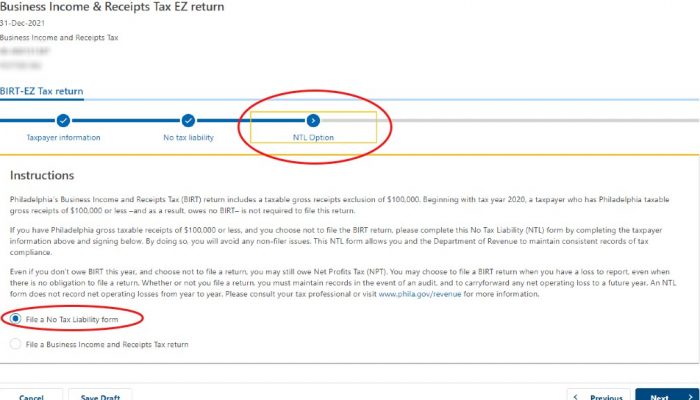

A return must be filed even if a loss is incurred.

. For more information about these changes please visit the Tax Center Guide. 20 rows Semi-monthly and weekly filers must submit their remaining 2021 Wage Tax returns and payments electronically through the Philadelphia Tax Center. Philadelphia Wage Tax Withheld on W-2 - The wage tax withheld is pulled from the Form W-2 s entered in the federal return if the locality.

The tax has often been cited as a job killer but it raises so much money that the city cant easily replace it. All Philadelphia residents owe the Wage Tax regardless of where they work. I live in NJ and work in Philadelphia.

For specific deadlines see important dates below. What is subject to the tax. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

Forms include supplementary schedules worksheets going back to 2009. In 2020 I worked from home for 9 months of the year due to COVID. Who pays the tax.

From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center. The Department of Revenue has provided important reminders regarding the new electronic processes for 2022. Non-residents who work in Philadelphia must also pay the Wage Tax.

Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city. Solved To file and pay the Earnings Tax by mail use the following address. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now.

Mail the application form to. Philadelphia Department of Revenue 1401 John F. For residents and 34481 for non-residents.

The deadline is weekly monthly semi-monthly or quarterly depending on the. These are the main income taxes. What is the city Wage Tax in Philadelphia.

Earnings Tax employees Due date. A business has nexus in Philadelphia and is. The income-based rates are 05 lower than standard rates.

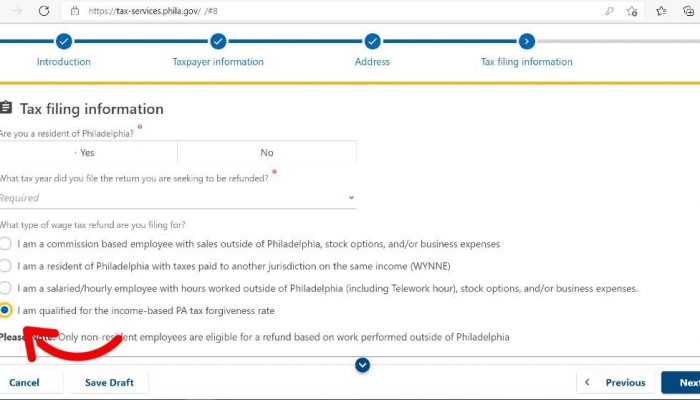

Sales Earned Outside of Philadelphia - Enter the number of days or hours employed outside Philadelphia. I usually claim a credit on my NJ return for the Philadelphia city wage taxes I paid. The City of Philadelphia is allowing individuals to request a refund of city wage tax paid under these circu.

If you dont receive a tax package you are still responsible for filing a return and paying the tax due. Use this form to file your 2021 Wage Tax. Before COVID-19 companies withheld Philadelphia wage tax from paychecks automatically.

Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. You will need to file Schedule. Philadelphia City Income Taxes to Know.

File returns and send quarterly payments to. The new rates are as follows. If no return is filed non-filer penalties are imposed.

In the state of California the new Wage Tax rate is 38398 percent. Wage and Earnings taxes. Tobacco and Tobacco-Related Products Tax.

How To File Philadelphia Wage Tax. Starting in 2022 all Wage Tax filings must be done in the Philadelphia Tax Center regardless of frequencies. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

Instructions for filing an annual reconciliation for 2021 Wage Tax. As of November 2021 The Philadelphia Tax Center is the new website for electronic filing and payment of BIRT NPT SIT Wage Earnings and Tobacco taxes. These forms help taxpayers file 2021 Wage Tax.

The City Wage Tax is a tax on salaries wages commissions and other compensation. To qualify your income must be subject to both the New Jersey income tax and the income or wage tax imposed by another jurisdiction outside of New Jersey for the same year. You can also file and pay Wage Tax online.

Non-residents who work in Philadelphia must also pay the Wage Tax. Additionally individuals who maintain a Commercial Activity License CAL must file a BIRT return even if they didnt actively engage in any business. The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022.

Philadelphia Beverage Tax PBT Understand the PBT notification-confirmation process. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly. Starting on July 1 the new resident rate for the Wage and Earnings taxes is 379.

Resolve business and incomeWage Tax liens and judgments. Sales Use. The tax applies to payments that a person receives from an employer in return for work or services.

If you are eligible residents pay 33712 non-residents 29481. Furthermore the rate of Earnings Tax for. Quarterly plus an annual reconciliation.

Expenses from 2106 - Enter the unreimbursed employee expenses as supported by the federal return. The new BIRT income tax rate becomes effective for tax year 2023 for returns due and taxes owed in 2024. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate of 35019 percent 035019.

City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Download forms and instructions to use when filing City tax returns. Use Occupancy Tax returns prior to 2014 must be obtained by 215 686-6600 or emailing revenuephilagov.

Business Income Receipts Tax Return BIRT Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

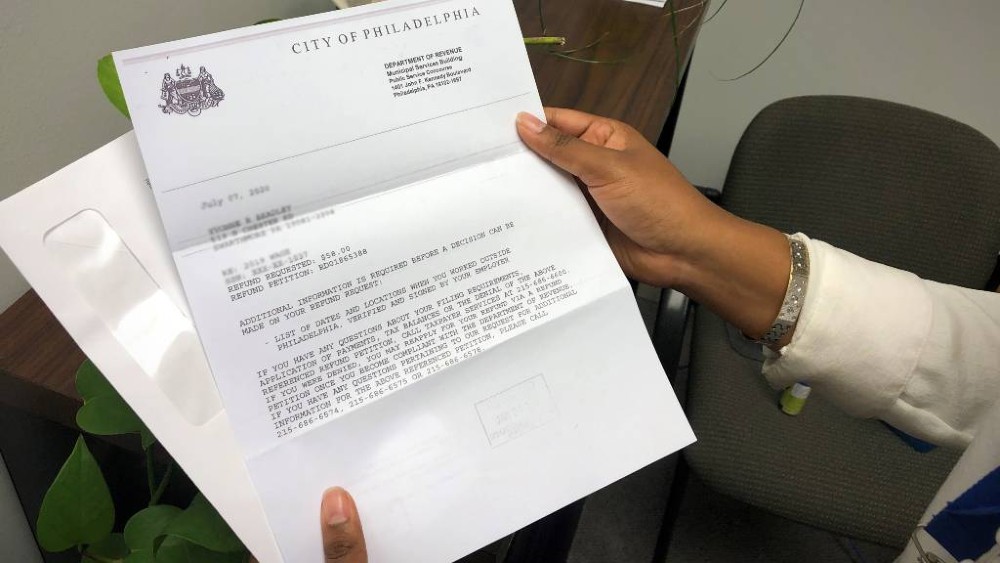

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

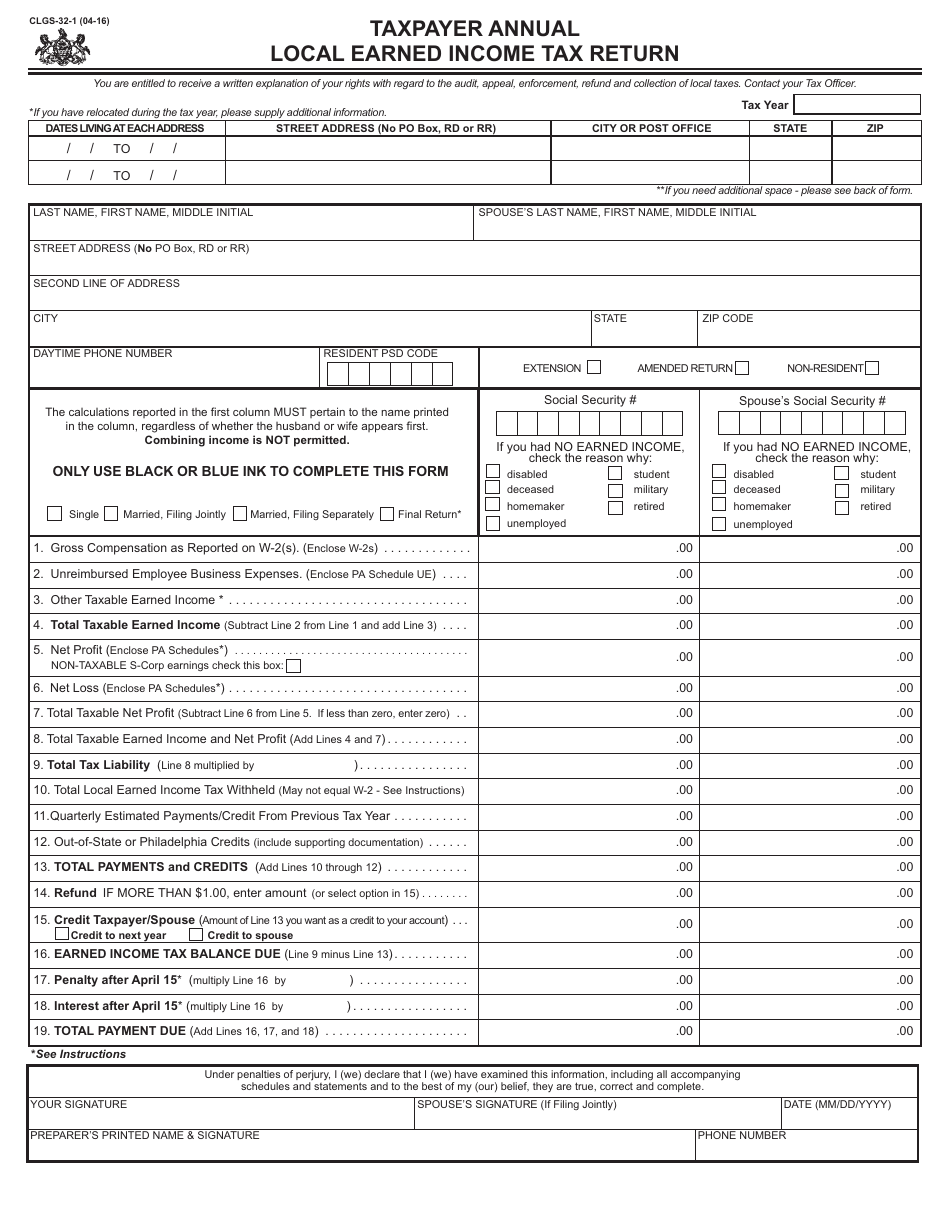

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

File Philadelphia Wage Tax Return Quarterly In 2022 Wouch Maloney Cpas Business Advisors

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Prepare The Annual Reconciliation Of Employer Wage Chegg Com

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

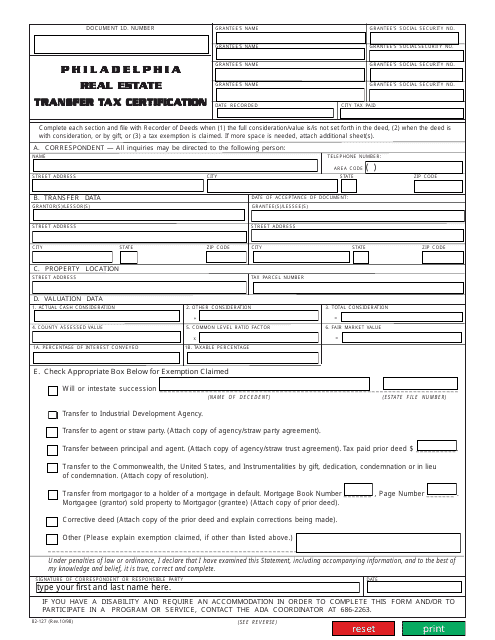

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

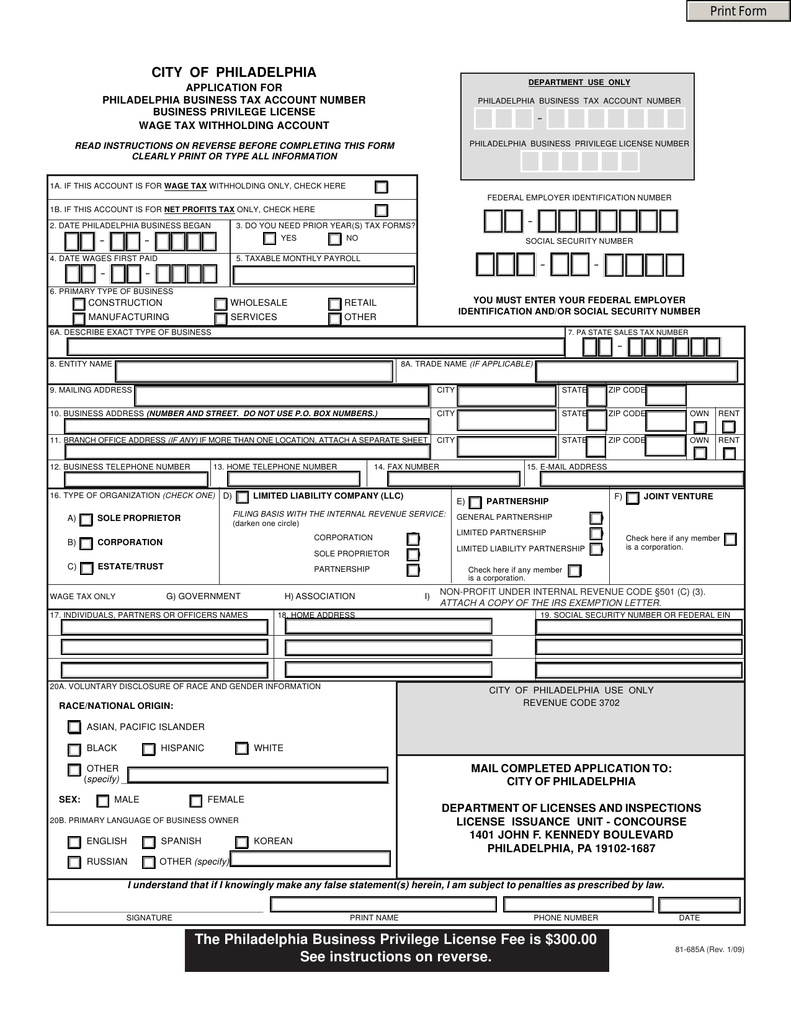

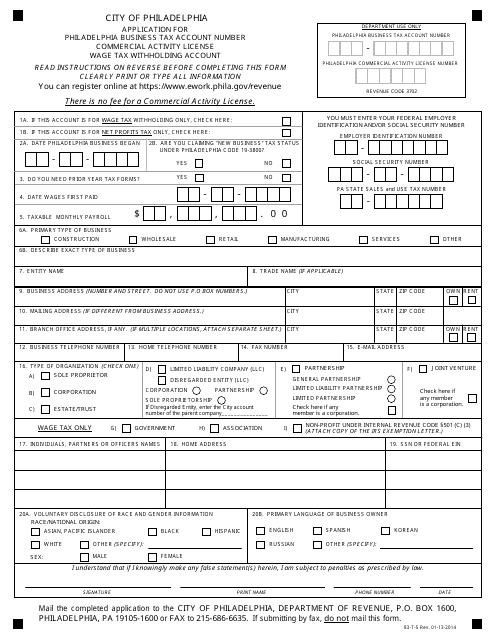

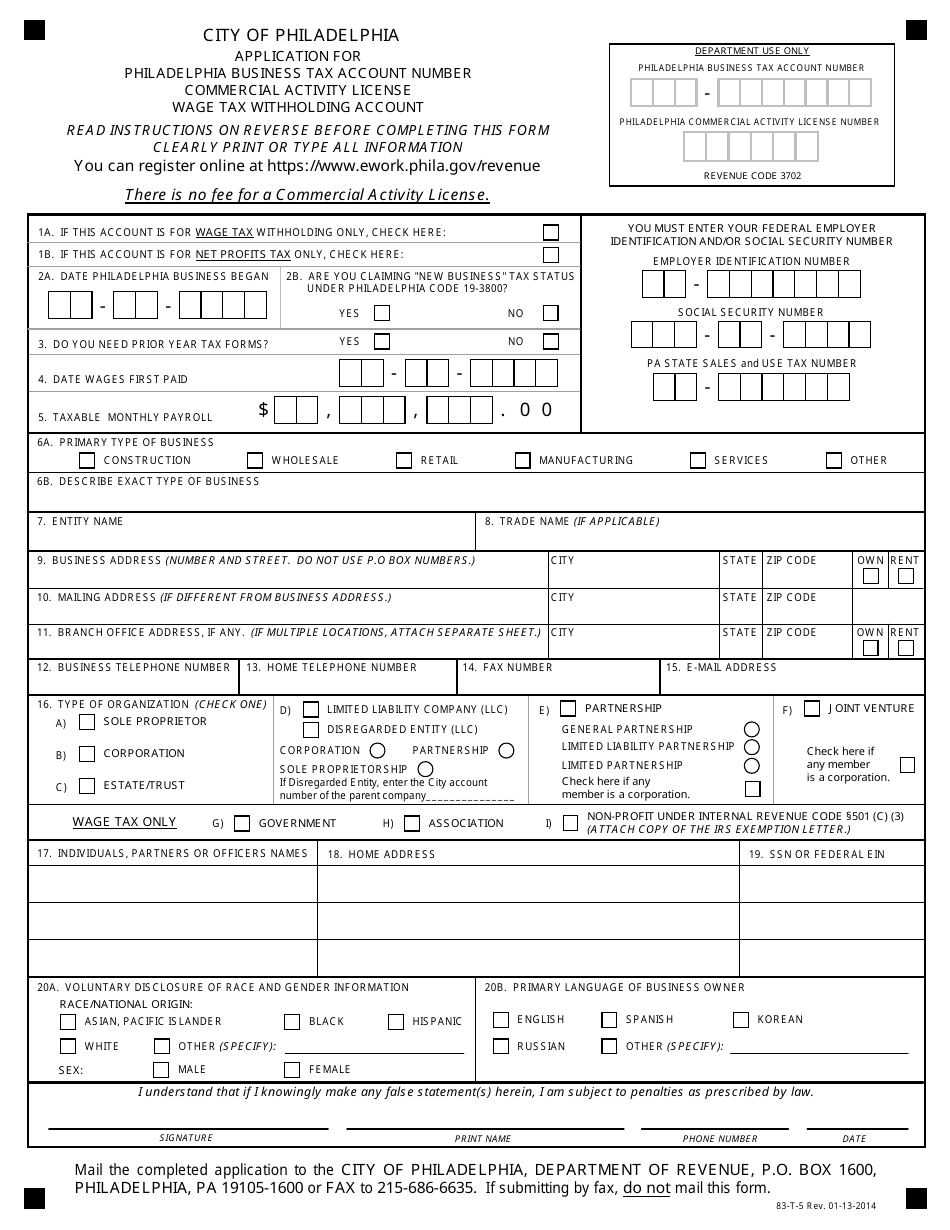

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Form Clgs 32 1 Download Fillable Pdf Or Fill Online Taxpayer Annual Local Earned Income Tax Return Pennsylvania Templateroller

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance