reit tax benefits uk

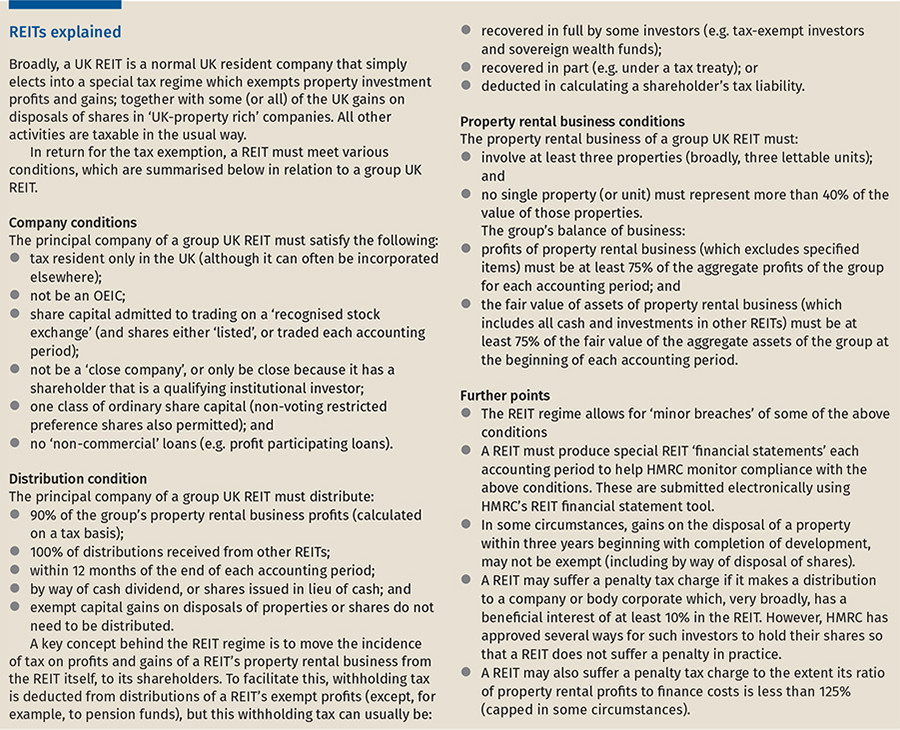

Youll pay at least 90 of your property rental business income to shareholders each year your investors will be taxed on this income as if theyve received income from property directly. See our Out-Law Guide to Stamp duty land tax for more information.

Furthermore a REIT is able to benefit from a rebasing of underlying property assets when it acquires a company owning property investments meaning that the target.

. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of that property business. REIT Tax Benefits No. The election exempts a REIT from paying corporation tax on its qualifying property rental income and capital gains.

A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT. Your REIT Income Only Gets Taxed Once When a. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

A normal UK company is required to pay. This removes the double layer of taxation at. For example the France UK tax treaty allows REITs to benefit from its provisions even if they are expressly excluded under withholding tax rules.

First the tax treaty can expressly mention the REITs as beneficiaries of the provisions of the tax treaty. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. But REITs do not pay any Corporation Tax.

On entry into the REIT regime and when REITs acquire companies owning property investments the assets are rebased to market value. REITs benefit from some pretty special tax advantages. Invest more than 75 of their assets in different types of property.

A UK- REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property rental business. A REIT is exempt from corporation tax on qualifying rental income and gains on sales of investment properties and shares in property investment companies used in its UK property rental business. If the tax treaty does not.

The REIT makes a distribution to a corporate shareholder that is beneficially entitled to 10 or more of its shares or dividends or that controls 10 or more of its voting rights. This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. This corporation tax is paid by the company before any dividends are paid out to investors.

To qualify as a REIT companies have to. Martin Lewis is encouraging people currently claiming Universal Credit UC or Tax Credits to look into an unbeatable bonus scheme offered by the UK Government after a money-saver thanked. Here are three big tax benefits you get when you invest in REITs.

So it makes sense that their accounting practices. Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of companies with a parent company that has elected to be a REIT under the UK tax legislation. Property rental business Property rental business profits and gains are tax-exempt within the REIT itself.

REIT Tax Benefits No. A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business carried on in the UK. Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status.

The benefits are considerable. In the hands of the shareholder property income distributions PID are taxable as profits of a. The Government has made the REIT regime more attractive with the changes to the legislation in recent years.

Earn more than 75 of their gross income from. This means that for a shareholder in a UK- REIT the tax impact is similar to direct investment in real estate. Investing in a REIT is passive but it also allows you to invest a relatively small amount of money.

As a REIT. The REIT is exempt from UK tax on the income and gains of its property rental business. UK REIT property income distributions are taxed as property income Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

REITs are subject to the normal stamp duty land tax rules in relation to property transactions. What are the Key Benefits of being a UK- REIT. In such cases the company is considered as resident under provisions of the tax treaty.

Tax status of a REIT. UK-resident individuals will be subject to income tax on PIDs at the normal rate of income tax with a current maximum rate of 45.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

The Lifecycle Of A Commercial Real Estate Deal Is A Long One With Many Moving Parts To Keep In Mind It S No Smal Commercial Real Estate Real Estate Commercial

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

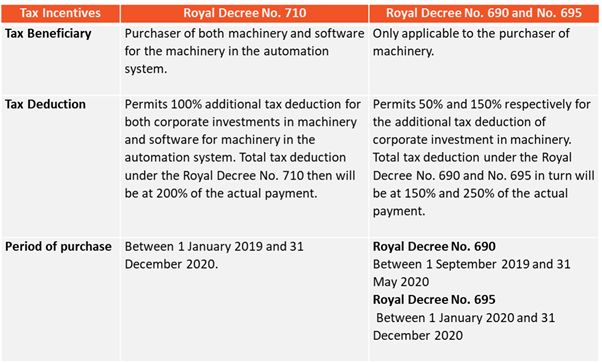

200 Tax Deduction In Thailand For Investment In Automation System Income Tax Thailand

Taxation Of Reits Ringing In The Changes

Tax Benefits Of Starting A Home Based Business Home Based Business Business Tax Business

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

How To Invest Money 13 Proven Investment Tips You Must Know Investment Tips Investing Investing Money

What Are The Best Reits To Invest In United Kingdom Investing Strategy Safe Investments Marketing Jobs

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

Real Estate Investment Trusts Tax Adviser

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide