north dakota sales tax on vehicles

To schedule an appointment please call 1-844-545-5640. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by the seller.

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

To calculate registration fees online you must have the following information for your vehicle.

. Or the following vehicle information. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. What is the sales tax on a car in North Dakota.

Lodging Restaurant Tax. Selling a vehicle with North Dakota title. An additional tax may be imposed on the rental of lodging and sales of prepared food and beverages.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. IRS Trucking Tax Center. North Dakota has recent rate changes Thu Jul 01 2021.

This page discusses various sales tax exemptions in North Dakota. Our free online North Dakota sales tax calculator calculates exact sales tax by state county city or ZIP code. The motor vehicle excise tax must be paid to the North Dakota department of transportations motor vehicle division when application is made for registration plates or for a certificate of title for a motor vehicle.

North Dakota has recent rate changes Thu. While the North Dakota sales tax of 5 applies to most transactions there are certain items that may be exempt from taxation. You will also need to pay a 5 title transfer fee 5 sales tax.

Cities and special taxation districts. 5 Sales Tax The North Dakota 5 sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi. Local Lodging Tax - May not exceed 2.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. The governing body of any city or county may by ordinance impose a city or county tax.

Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle. Its exciting to buy a new or new for you car but its also far from cheap. Motor vehicle fuel tax.

The 5 sales tax and the 3 rental surcharge are separate charges with each applying to the rental charges and are in addition to motor vehicle excise tax paid on the vehicle purchase price. When the owner of a vehicle. Gross receipts tax is applied to sales of.

With local taxes the total sales tax rate is between 5000 and 8500. North Dakota sales tax is comprised of 2 parts. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. The state sales tax rate in North Dakota is 5000. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on top of the state tax.

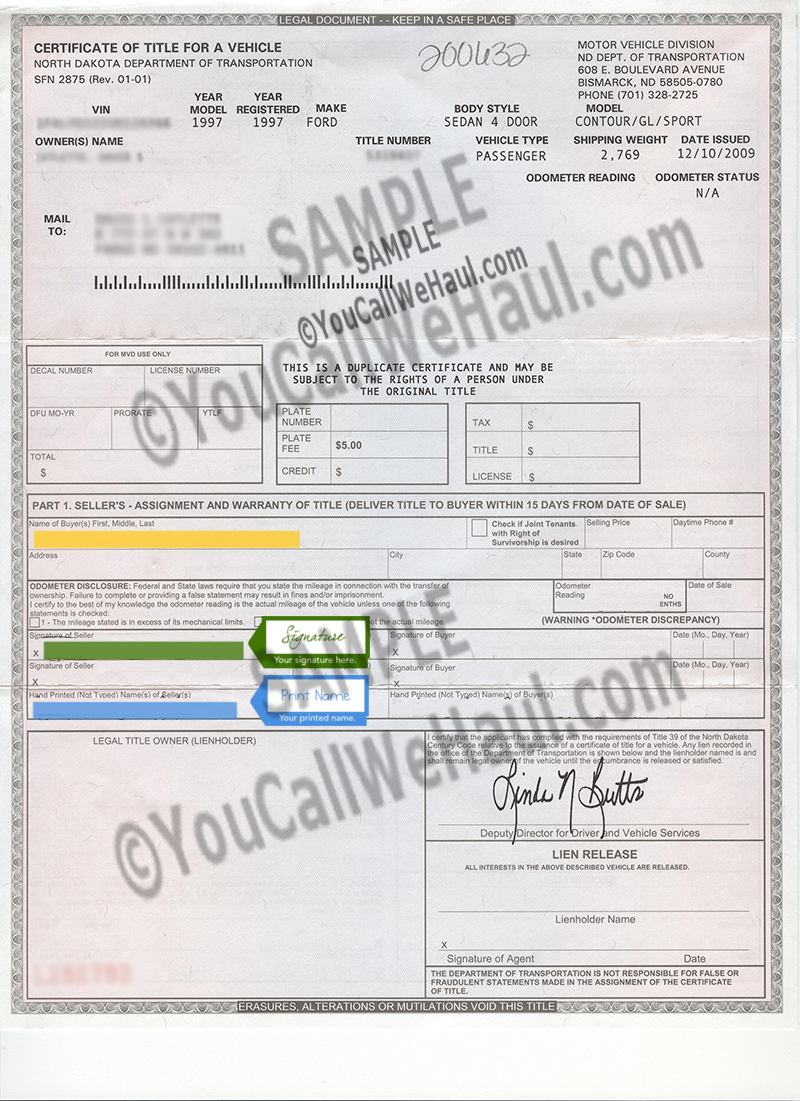

There is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required. How to complete a North Dakota Motor Vehicle Title. The motor vehicle excise tax is in addition to motor vehicle registration fees for license plates.

North Dakota imposes a sales tax on retail sales. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor. Sales Tax Exemptions in North Dakota.

This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax. North Dakota Sales Tax. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Average Sales Tax With Local. In North Dakota there are 3 types of motor fuel tax. If the vehicle was purchased outside of the United States there is no tax reciprocity.

Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. That state we would require proof of tax paid to exempt you from North Dakota excise tax. Select the North Dakota city from the list of popular cities below to see its current sales tax rate.

Taxes would be due on the purchase price based on exchange at a rate of 5. Heavy Vehicle Use Tax. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

When you buy a car in North Dakota be sure to apply for a new registration within 5 days. The sales tax is paid by the purchaser and collected by the seller. The Dealer Handbook contains laws and policies pertaining to vehicle sales.

Many cities and counties impose taxes on lodging and prepared foods and beverages. By using the North. But in North Dakota youll need to be prepared to spend additional money on these extra costs.

North Dakota Title Number. The motor vehicle excise tax is 5 of the purchase price the sales price less any trade-in amount or if the vehicle is acquired by means other than purchase the tax is 5 of the fair market value. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10 years old. There are a total of 213 local tax jurisdictions across.

5 tax on vehicle purchase price or fair market value of vehicle. 2290 IRS Filing Requirements. You can find these fees further down on the page.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. For vehicles that are being rented or leased see see taxation of leases and rentals.

North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3. North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit.

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

What S The Car Sales Tax In Each State Find The Best Car Price

Minot State University Approved Logo Animales

Rhode Island 2003 Non Passenger Plate Issue Embossed Navy Blue Serial On Reflective White Plate With Gray Wave Graphic Rhode License Plate Car Plates Plates

Pin On Jerry S Chevrolet Of Beresford

Nj Car Sales Tax Everything You Need To Know

Car Sales Tax In North Dakota Getjerry Com

Infiniti Qx80 Lease Deals Incentives Special Offers Lease Deals Infiniti Usa Infiniti

Tennessee 2020 Passenger Issue This New Baseplate Was Introduced In January 2006 And Replaced All Previous Issues By The End License Plate Car Plates Plates

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

What S The Car Sales Tax In Each State Find The Best Car Price

The End Of The Chicago Trolley Era Chicago Detours Chicago Navy Pier Illinois

A Complete Guide On Car Sales Tax By State Shift

Pin On Form Sd Vehicle Title Transfer

North Dakota Auto Dealer Bond A Comprehensive Guide Bond Exchange