net investment income tax 2021 proposal

The top federal corporate income tax rate fell from 35 percent to 21 percent beginning in 2018. The following options can be considered for saving on income tax.

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Earned Income Tax Credit EITC resources.

. Tax benefit 6 as per prevailing tax laws. Due to the crisis that the country faced during 2020 the central government had decided not to make any changes to the income tax slab for FY 2021-22 and carry it on it the new FY 2021-22. For 2031 the SALT deduction cap would be set at 10000.

Tax Guide 20202021. However there was an exemption made towards the new slab. Accidental death benefit 5 cover up to 2 crore optional.

Mutual funds such as Equity Linked Savings Schemes ELSS can be claimed for tax deduction under Section 80C. Ensure right life cover1 to protect yourself adequately at every life-stage 2. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a.

Query however whether as ordinary income this recapture would be treated as qualified business income for purposes of IRC Section 199A. For Tax Year 2020. Modifying self-employment and net investment.

Other than that from the carrying on of any trade but including investment income and capital gain transactions is deemed to accrue to the spouses who are married in community of property in equal portions. 38398 for Philadelphia residents. Sales Use Hotel Occupancy Tax.

Get claim payout on diagnosis of 64 critical illnesses 4 optional. Get 105 of your premium back 3 or get monthly income from age 60 on survivalmaturity. Tax Guide 20162017.

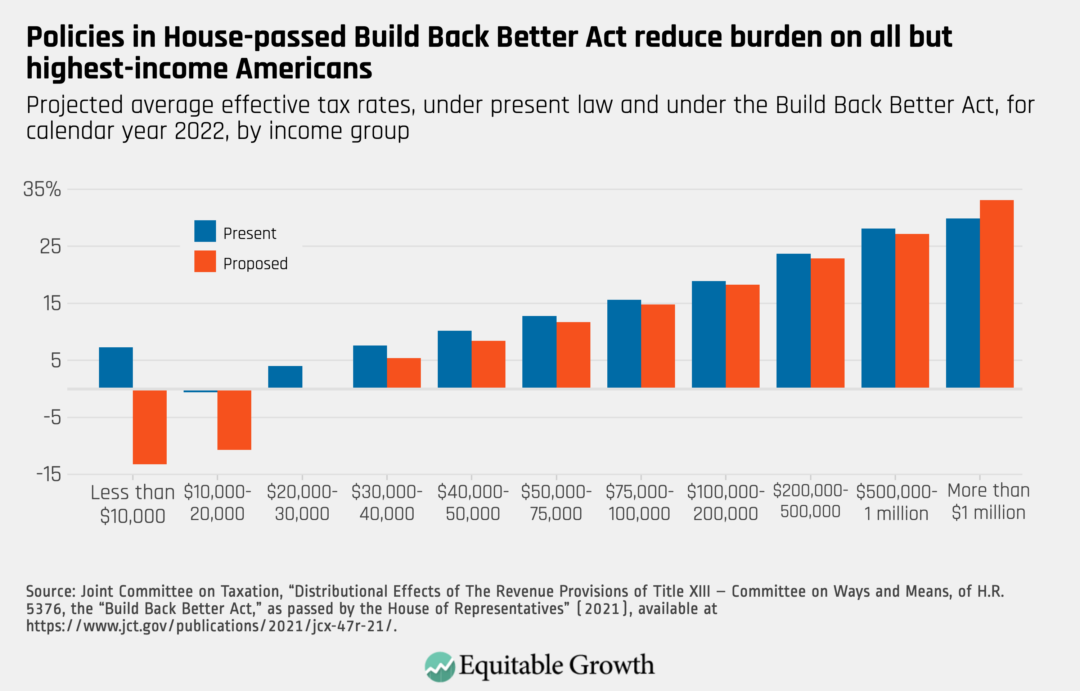

Tax Proposals by the Biden Administration. In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which greatly changed the way corporations pass-through businesses and individual taxpayers were treated in the tax code. Net Profits Tax.

Income tax for FY 2021-22 applies to all residents whose annual income exceeds Rs25 lakh pa. Healthy Beverages Tax Credit. Would lead to an.

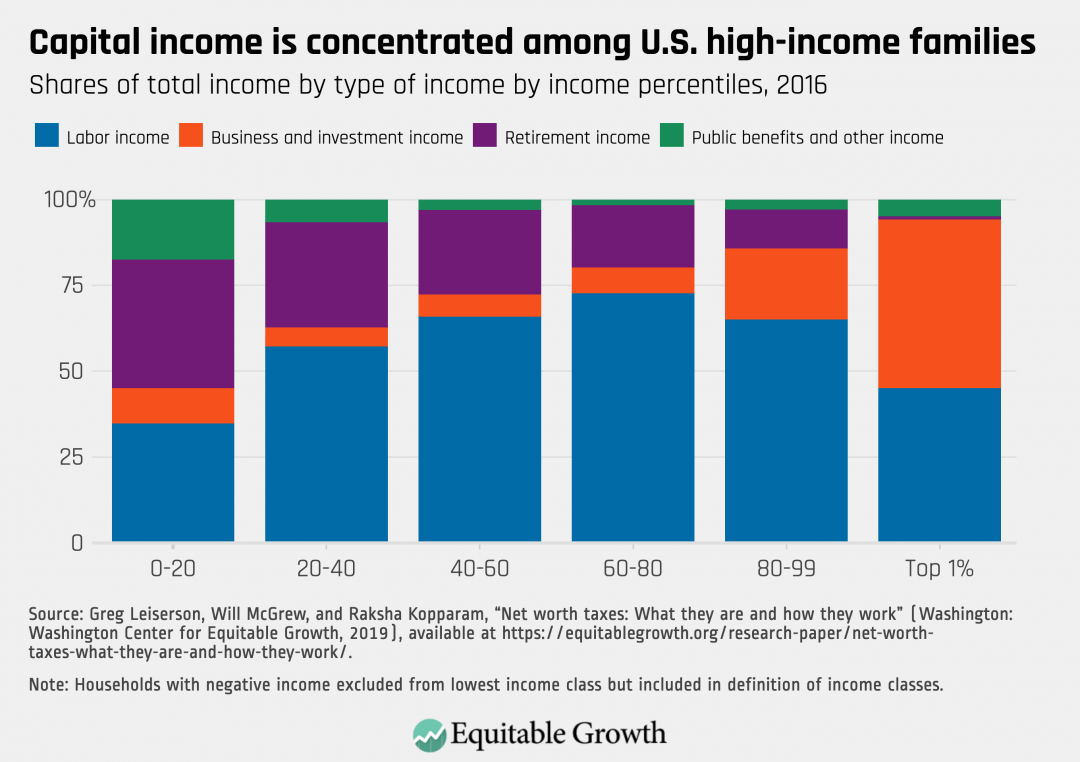

A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets. For Tax Year 2021. The 80000 SALT cap amount would also apply to the 2021 tax year.

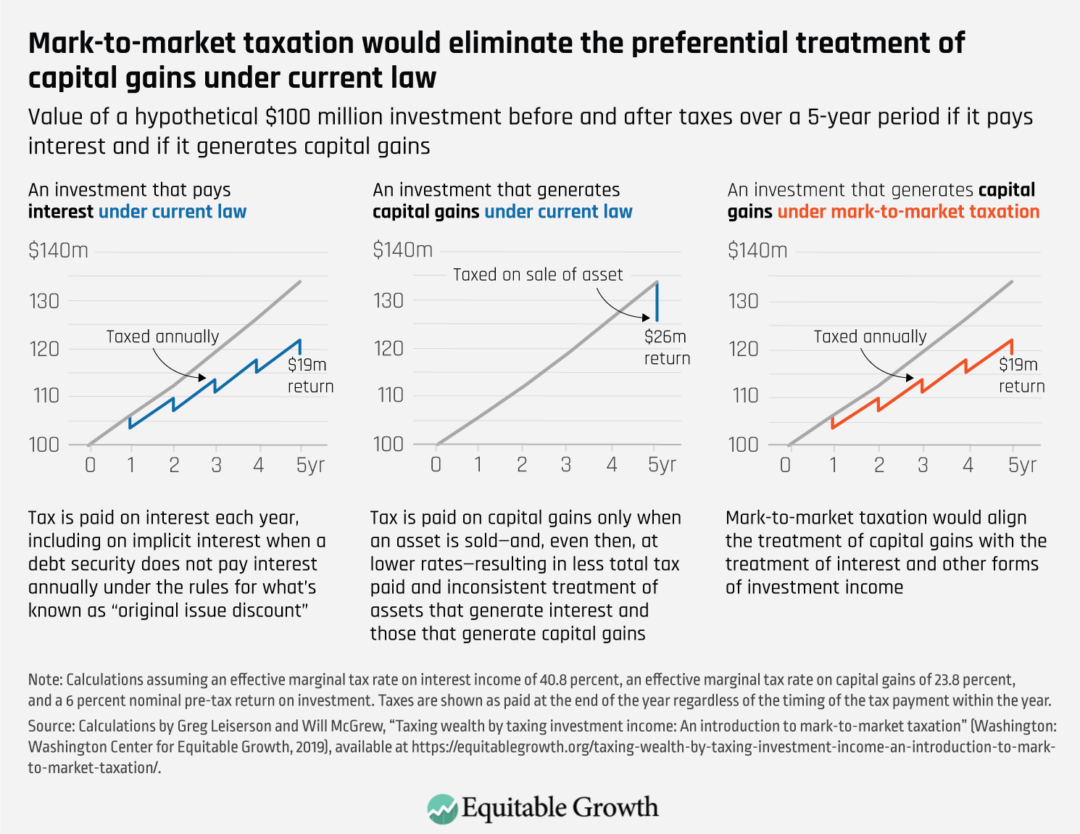

Expand the base of the 38 percent Net Investment Income Tax NIIT to. You can achieve more deductions on tax. This proposal would cause post-2021 depreciation deductions on real property to be recaptured upon sale at ordinary rates as high as 37 under current law.

New Income Tax Slabs Rates for FY 2021-22 AY 2022-23.

House Democrats Propose Hiking Capital Gains Tax To 28 8

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

What Is The The Net Investment Income Tax Niit Forbes Advisor

House Democrats Tax On Corporate Income Third Highest In Oecd

Proposed Legislation Includes Tax Increases Focused On High Income Individuals And Corporations Koley Jessen

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Like Kind Exchanges Of Real Property Journal Of Accountancy

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

House Ways And Means Committee Tax Proposal

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Here S How Biden S Build Back Better Framework Would Tax The Rich

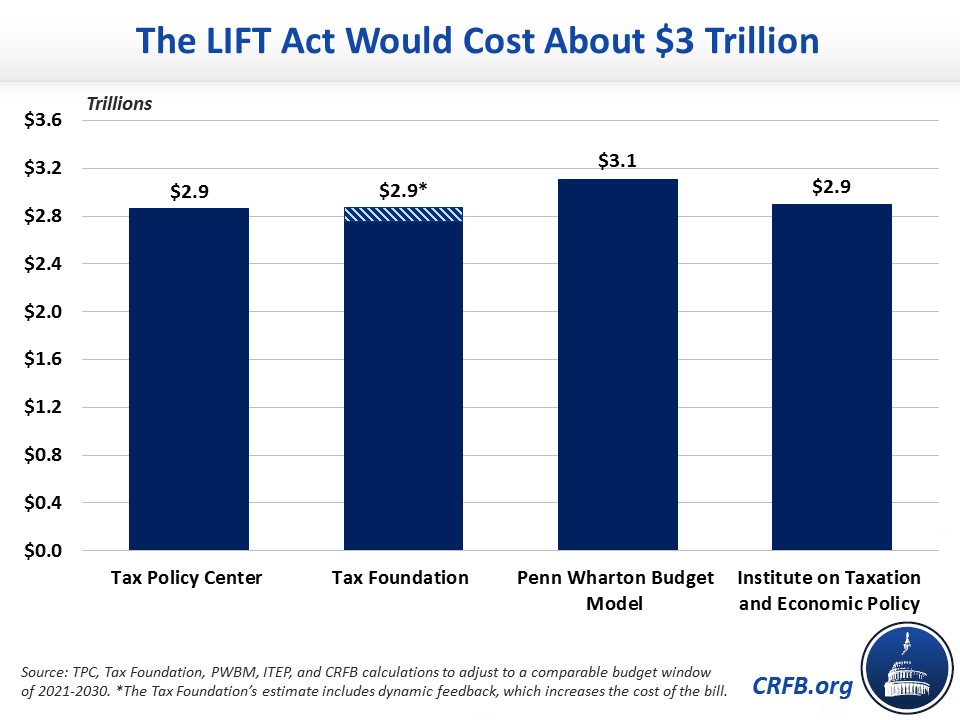

Kamala Harris S Lift The Middle Class Act Committee For A Responsible Federal Budget

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Summary Of Fy 2022 Tax Proposals By The Biden Administration